Handy Reasons On Choosing Gold Bullion Prague

Wiki Article

What Should I Think About Prior To Making A Decision To Invest In Gold Bullion Or Coins?

If you're thinking of investing in bullion or gold coins in the Czech Republic, several factors are essential to keep in mind: Trustworthy Source- Purchase gold coins or bullion from trusted and reliable sources. Accredited dealers or organizations guarantee authenticity and quality.

Purity and Weight - Check purity and weight. Gold bullion is typically available in various levels of purity and weights (e.g., 24-karat, 22-karat, etc.). It must be in compliance with standard specifications.

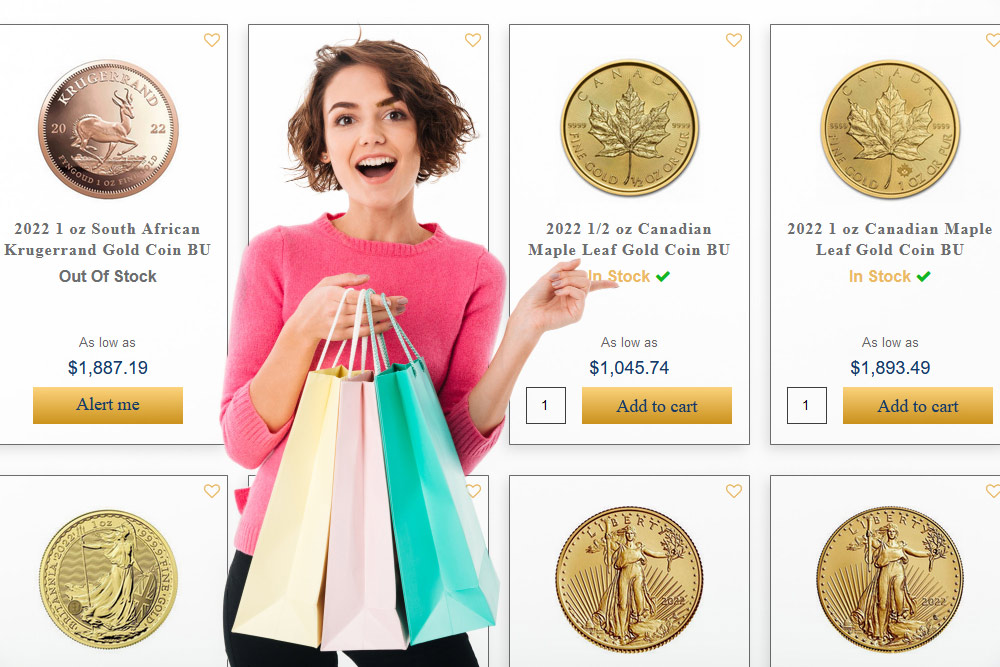

Understanding the price and premiums. This includes understanding the price structure for gold, and any premiums levied by dealers. Compare prices with different sellers to find the most profitable investment.

Storage and Security - Think about safe and secure options for storing your gold. Some investors prefer to keep their gold at the bank, or in an specialized facility due to security issues.

Liquidity and Options to SellCheck the ease of selling whenever it is necessary. Select coins or other metals that are easy to sell and have high liquidity. Follow the top buy Gold Czechia for more tips including gold and silver dealers, gold bullion, 1 ounce of silver, one oz of gold, purchase gold bar, euro coins, kruger rand, bullion dealers near me, purchase physical gold, 1 10 ounce gold coin and more.

How Can I Tell Whether The Gold I Purchase Is Authenticated And Has All The Necessary Documentation?

To make sure that the gold you buy comes with proper documentation and certificates of authenticity Follow these steps

Ask the seller for documentation - It is recommended to ask directly the seller or the dealer for the evidence. Sellers with good reputation usually provide authenticity certificates or assay certifications when purchasing. Inquire for Specific Information- Request more details on the documents supplied. Certificates should include information about the item. This includes its weight, purity (in Karats) manufacturing company, hallmark and any other pertinent information.

Check the Certificates - Carefully look over the certificates or documents accompanying the gold. Ensure they include the seller's details, date of purchase, and any seals or marks that prove their authenticity.

Check the authenticity of certificates and gold objects. Verify that the gold item's hallmarks or purity marks, or any other identifying characteristics match the information on the document.

Verify authenticity of the source - Examine the credibility of issuing entity or the certification authority. It's important to ensure that the organization is a certified laboratory or government agency, as well as a certification agency. See the best zlatovna.cz precious metals for blog advice including 2000 gold dollar, buy gold bullion, 1 oz gold buffalo coin, double eagles, gold and bullion, apmex gold, krugerrand gold coin, platinum coins, apmex gold coins, gold eagle and more.

What Is A Small Mark-Up On The Stock Market And A Small Price Spread For Gold?

Low price spread and the term "low markup" are employed in the context of gold trading to describe the costs involved in buying or selling gold based on the market value. These terms are related to how much extra you could be charged (markup) or the price difference between selling and buying prices (spread) beyond the market value of the gold. Low mark-up- This refers to a dealer charging only a small premium over the market value. A low mark-up implies that the cost you pay to purchase gold is comparable or even slightly more than the market price.

Low Price spreadThe price spread represents the difference between the selling and buying prices (ask and bid) for gold. A low price spread is a small gap between these prices, meaning there's less an asymmetry between the price you pay to buy gold and the price that you can sell it.

What Is The Markup And Price Between Gold Dealers Vary?

The mark-ups and price spreads for gold may differ significantly between dealers based on many factors, including their operations, models of business as well as their reputation and pricing strategies. These are some general information regarding the variations: Dealer reputation and service quality- Established and reputable dealer might charge more due to perceived high-quality, superior customer service, and reliability. Dealers who are less experienced or more recent may have lower markups in order to attract new customers.

Business Model and Overhead Costs- Dealers with physical storefronts or premium services could have more overhead expenses, which can lead to higher mark-ups to cover these costs. Dealers that are online or with less operating expenses may be able to provide more competitive pricing.

Pricing Transparency: Dealers that are transparent about their pricing structure are more likely to offer lower markups and tighter spreads. This is likely to attract customers who are interested in knowing the price in advance.

Given these factors that are affecting gold prices, it is essential for investors to conduct a thorough study to compare prices from a variety of dealers, and look at factors beyond mark-ups and spreads like reputation, reliability, and customer service, when selecting an agent. When you shop around and compare prices, you will be able to find competitive prices on gold. Have a look at the top rated zlatovna.cz precious metals for site tips including twenty dollar gold coin, american gold eagle, gold investment companies, liberty gold coin, gold buffalo coin, five dollar gold coin, 1oz of gold, buy gold and silver, gold and silver buyers near me, gold stocks price and more.